Exempt Supplies in the UAE: Exempt Supplies are those supplies of goods and services where no VAT will be charged

The input tax paid on these supplies is irrecoverable. If a person is making both taxable and exempt supplies, that person is partially exempt and hence may or may not be able to claim the input tax. The input tax which is directly related to taxable supplies can be recovered but the input tax directly related to exempt supplies can’t be claimed.

Input apportionment rules apply when the input tax is related to both the taxable and exempt supplies (Consultancy fee and overheads)

Formula of Apportioning Input Tax

Total of Recoverable input tax (Divided by) Total of Recoverable and non-recoverable input tax

This formula will give a percentage that will be rounded to be applied to the residual input tax

There are also the other alternative ways which are based on different criteria, such as;

a) The number of transactions

The total number of taxable transactions in the quarter (Divided by) the total number of transactions in the quarter

b.) Floor area

The floor area used to make taxable supplies vs The floor area used to make exempt supplies;

c.) Staff numbers

Total staff employed on the taxable business vs Staff numbers are used in the exempt business.

In b and c above both, the numbers are compared to get the formula for the residual input tax

Following supplies are the exempt supplies in the UAE :

Financial services

The Financial Services includes the following

- Currency exchange either by the exchange of bank notes or coin, by crediting and debiting accounts, or otherwise.

- Issuing, making the payment, collecting, or transferring of ownership of a cheque

- Issuing, making the allotment, drawing, accepting, endorsing, or transferring of ownership of a debt security.

- Giving of any loan or an advance or a credit.

- Renewing or making variation of a debt security or an equity security or a credit contract

- Providing, taking, making variation, or releasing of a guarantee or an indemnity or a security or a bond in respect of performing of obligations under a cheque, a credit, an equity security

- Operating current, a deposit or a savings account.

- Providing or transferring of ownership of financial instruments such as derivatives, options, swaps etc.

Financial Service includes life insurance and financial services that are not conducted for an explicit fee, discount, commission, rebate, etc.

i) Residential buildings

The residential building is exempt from VAT and it excludes the residential building which are zero-rated

ii) Bare land

The supply of bare land is also exempt from tax

But there is a condition for the bare land to be treated as exempt is that there are no buildings or engineering works on the bare land. However, the presence of roads, water pipes, cables don’t stop the land to be treated as exempt

iii) Local passenger transport

The provision of transport services locally is exempt also

It means the transport service is provided inside the UAE through qualifying vehicles by land, air or sea

Examples include the following

- Taxi ride from one place to another

- Trip on a bus, tram or train

- Internal flights

- ferry boat

In all the above cases the transport is designed or adapted for the transport of passengers.

Pleasure trips for sight-seeing, catering aboard and general entertainment are not exempt supplies

In addition to the exempt supplies mentioned above tourists are also exempted from VAT as they can take back 85% of the total VAT paid when they are purchasing from any shop which is registered for the Tourist Refund Scheme with the Planet Payment System. The tourist will show the documents at the airport to take back the VAT paid at the time of their shopping.

VAT Resgistration and exempt supplies in the UAE

All the persons making the taxable supplies exceeding the AED 375,000 should get themselves registered.

It’s worth noting here that the exempt supplies and out of scope supplies are not considered while checking the above threshold

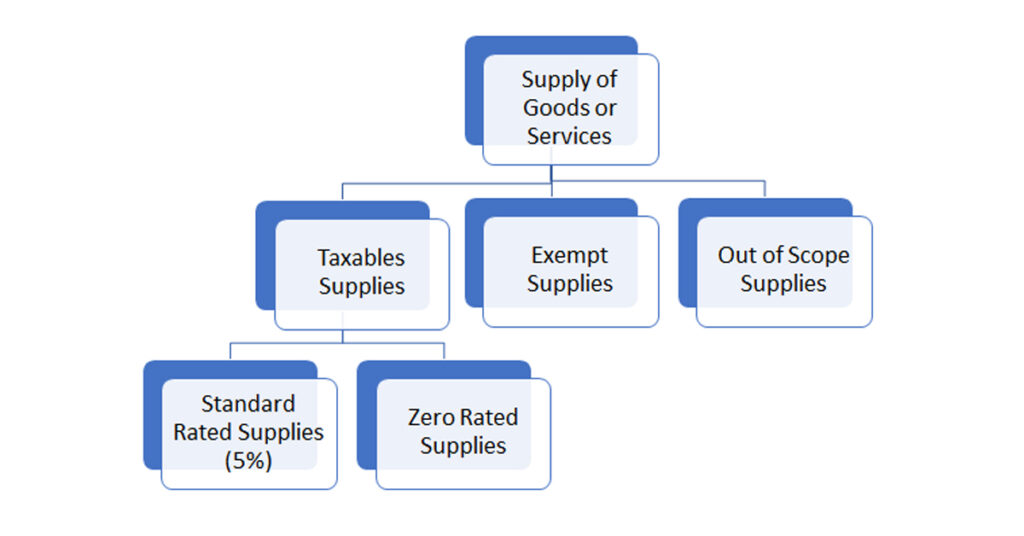

What is the difference between Zero-rated and exempt supplies in UAE VAT ?

The Zero-rated supplies are those supplies of goods or services where the VAT is charged but is charged at the rate of Zero percent. It means the supplies are taxable and hence the input tax attributable to these supplies is recoverable. In exempt supplies, the VAT is not charged altogether so whatever the input tax is attributable to the exempt supplies is not recoverable

The other difference between the taxable and exempt supplies is the value of zero-rated supplies is taken into consideration while determining the threshold for registration while the value of exempt supplies is not considered while determining the threshold for the registration or deregistration.

Examples of Zero-Rated Supplies

- The supplies of goods and services related to Preventive and basic healthcare services.

- The supplies of goods and services related to Education as nurseries school education, and higher educational institutions which are owned or funded by federal or local government.

- supplies of goods and services related to Crude oil and natural gas.

- Buildings which are converted from non-residential buildings to residential buildings by sale or lease.

- Buildings which are specifically designed for use by charities by sale or lease.

- Residential buildings with in the period of three years form the date of its completion, either through sale or lease in whole or in part.

- Investments in precious metals.

- Supplies of Goods and services which are related to transfer of goods or passengers on land, air or sea.

- Sale of goods and services (exports) outside the GCC.

Contact us for any clarrrification or assistance required for your VAT , Accounting and other business needs.