CALL NOW 971-55 692 6522

Service Benefits

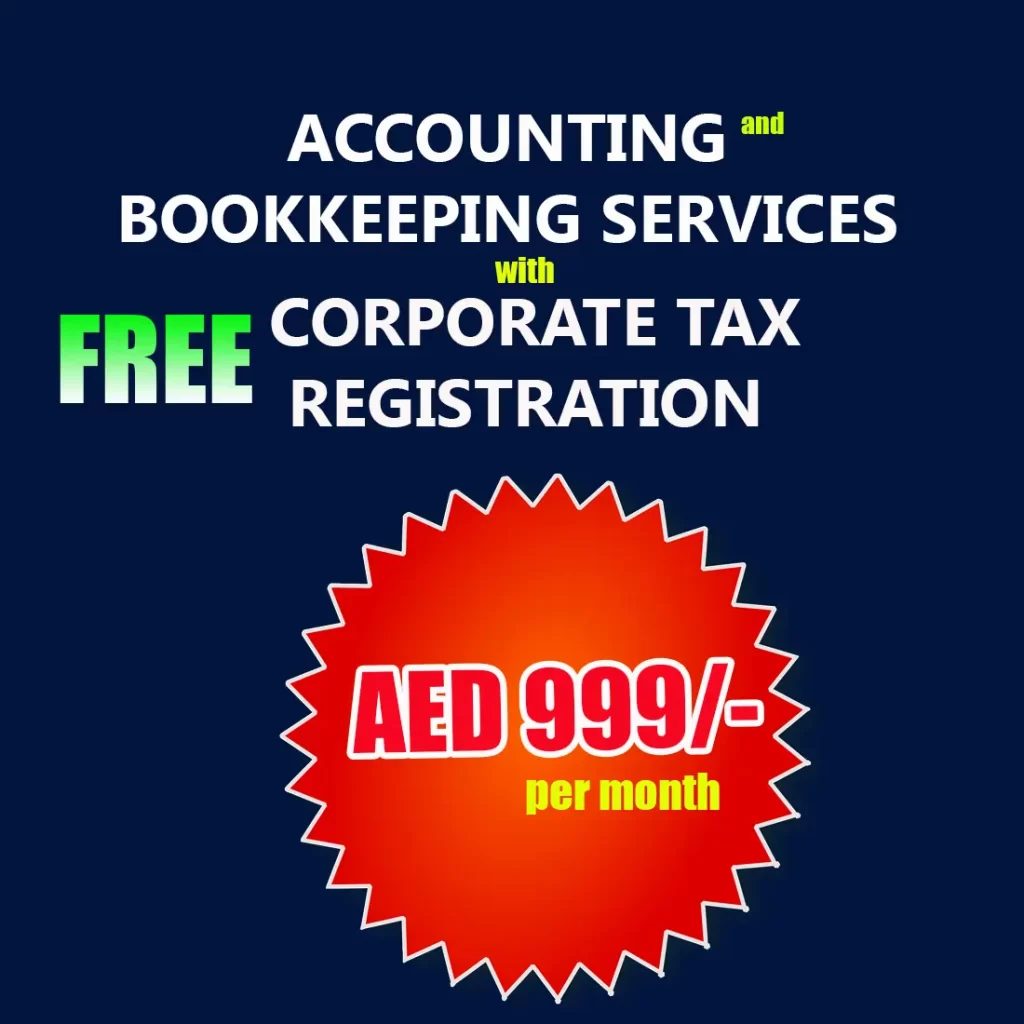

- Expertly handle initial planning and accounting to guarantee full compliance with corporate tax regulations.

- Provide a comprehensive and detailed annual audit report at the conclusion of each fiscal year.

- Monthly reports – Stock report, Profit and Loss, Balance sheet, and any other required by management

- Efficiently record daily sales and VAT in accounting software (e.g., Wingold, Tally, or any other) following FTA regulations.

- Our team expertly records purchases and expenses, distinguishing between VAT claimable and non-claimable items, ensuring optimized input tax handling.

- Updating accounts receivables, payables, and stock, providing reports as required by management.

- Performing bank, cash, and stock reconciliations.

- Conducting VAT calculations and submissions.

Corporate Tax Registration in the UAE

Beginning in June 2023, the UAE will implement a new corporate tax structure at the federal level that will apply to select enterprises. This means that businesses participating in certain activities will have to pay taxes on their profits.

The new regime’s tax rate has been set to 9% lower than in some other countries. As part of its efforts to diversify the economy and reduce its reliance on oil revenue, the UAE is establishing a business tax. This is also consistent with worldwide best practices and standards.

It should be noted that not all enterprises are subject to corporate taxation.

Companies that do not have a permanent establishment in the UAE are not required to register or pay corporate tax. This exemption is applicable to businesses that operate outside of the country. Such businesses are exempt from the UAE’s corporate tax legislation, which will go into effect in June 2023.

The implementation of corporate taxation in the UAE is a significant development that will have an impact on enterprises operating in the nation. Businesses should stay up to date on new tax legislation and ensure compliance to prevent legal complications or penalties.

List of documents needed to register for Corporate Tax in the UAE

To register for corporate tax in the UAE, you must present a copy of your unexpired trade license, as well as the license owner/partners’ Emirates ID and passport. You must also send the Memorandum of Association (MOA) or Power of Attorney (POA), as well as your contact information, including your phone number and email address.

You will also need to enter your company’s contact information, such as your P.O. Box, landline number, building name, building number, and street number. Giving correct and comprehensive information ensures a smooth registration procedure and compliance with the UAE’s corporation tax requirements.

- Copy of Trade License (must not be expired).

- Emirates ID & Passport copy of the owner/partners who own the license (must not be expired).

- Memorandum of Association (MOA)

Or

Power of Attorney (POA) - Concerned person’s contact details

(Mobile Number and E-mail) - Contact details of the company ( P.O. Box, Landline number, Building name & Number, Street No.)

What is the Corporate Tax rate in the UAE?

The corporate Tax rate in the UAE will be 0% for companies having profits up to 375,000 per annum and 9% for those who have profits above 375,000.

How the Corporate Tax in the UAE is Calculated?

The calculation of corporate tax liability in the UAE is based on a tiered system. In the event that a business has earned taxable income of AED 450,000 in a financial year, its corporate tax liability will be calculated as follows:

Firstly, the portion of taxable income of up to AED 375,000 is taxed at a rate of 0%, which amounts to AED 0.

Secondly, the remaining portion of taxable income exceeding AED 375,000 (i.e. AED 75,000) will be taxed at a rate of 9%, which amounts to AED 6,750.

Therefore, the total corporate tax liability for the year will be the sum of both amounts, which equals AED 6,750. This is how the UAE corporate tax is calculated using the tiered system based on the business’s taxable income.